Capitalism

| Part of the series on Capitalism |

|

Concepts

Economic theories

Origins

People

Variants

Related topics

Movements

|

Capitalism is an economic system in which the means of production and distribution are privately owned and operated for a private profit; decisions regarding supply, demand, price, distribution, and investments are made by private actors in the market rather than by central planning by the government; profit is distributed to owners who invest in businesses, and wages are paid to workers employed by businesses.

Some define capitalism as where all the means of production are privately owned, and some define it more loosely where merely "most" are in private hands —while others refer to the latter as a mixed economy based toward capitalism. More fundamentally, others define capitalism as a system where production is carried out to generate profit, or exchange-value, regardless of legal ownership titles. Private ownership in capitalism implies the right to control property, including determining how it is used, who uses it, whether to sell or rent it, and the right to the revenue generated by the property.[1] Capitalism also refers to the process of capital accumulation.

There is no consensus on the precise definition of capitalism, nor how the term should be used as an analytical category.[2] There is, however, little controversy that private ownership of the means of production, creation of goods or services for profit in a market, and prices and wages are elements of capitalism.[3] There are a variety of historical cases to which the designation is applied, varying in time, geography, politics and culture.[4]

Economists, political economists and historians have taken different perspectives on the analysis of capitalism. Economists usually emphasize the degree that government does not have control over markets (laissez faire), and on property rights.[5][6] Most political economists emphasize private property, power relations, wage labor and class.[7] There is general agreement that capitalism encourages economic growth[8] while further entrenching significant differences in income and wealth. The extent to which different markets are free, as well as the rules defining private property, is a matter of politics and policy, and many states have what are termed mixed economies.[7]

Capitalism as a deliberate system of a mixed economy developed incrementally from the 16th century in Europe,[9] although proto-capitalist organizations existed in the ancient world, and early aspects of merchant capitalism flourished during the Late Middle Ages.[10][11][12] Capitalism became dominant in the Western world following the demise of feudalism.[12] Capitalism gradually spread throughout Europe, and in the 19th and 20th centuries, it provided the main means of industrialization throughout much of the world.[4] Variants of capitalism include: anarcho-capitalism, corporate capitalism, crony capitalism, finance capitalism, laissez-faire capitalism, late capitalism, neo-capitalism, post-capitalism, state capitalism, state monopoly capitalism and technocapitalism.

Contents |

Etymology and early usage

|

Other terms sometimes used for capitalism:

|

Capital evolved from Capitale, a late Latin word based on proto-Indo-European kaput, meaning "head"—also the origin of chattel and cattle in the sense of movable property (only much later to refer only to livestock). Capitale emerged in the 12th to 13th centuries in the sense of funds, stock of merchandise, sum of money, or money carrying interest.[10][20][21] By 1283 it was used in the sense of the capital assets of a trading firm. It was frequently interchanged with a number of other words—wealth, money, funds, goods, assets, property and so on.[10]

The term capitalist refers to an owner of capital rather than an economic system, but shows earlier recorded use than the term capitalism, dating back to the mid-seventeenth century. The Hollandische Mercurius uses it in 1633 and 1654 to refer to owners of capital.[10] Arthur Young used the term capitalist in his work Travels in France (1792).[21][22] David Ricardo, in his Principles of Political Economy and Taxation (1817), referred to "the capitalist" many times.[23]

Samuel Taylor Coleridge, an English poet, used capitalist in his work Table Talk (1823).[24] Pierre-Joseph Proudhon used the term capitalist in his first work, What is Property? (1840) to refer to the owners of capital. Benjamin Disraeli used the term capitalist in his 1845 work Sybil.[21] Karl Marx and Friedrich Engels used the term capitalist (Kapitalist) in The Communist Manifesto (1848) to refer to a private owner of capital.

The term capitalism appeared in 1753 in the Encyclopédia, with the narrow meaning of "The state of one who is rich".[10] However, according to the Oxford English Dictionary (OED), the term capitalism was first used by novelist William Makepeace Thackeray in 1854 in The Newcomes, where he meant "having ownership of capital".[21] Also according to the OED, Carl Adolph Douai, a German-American socialist and abolitionist, used the term private capitalism in 1863.

The initial usage of the term capitalism in its modern sense has been attributed to Louis Blanc in 1850 and Pierre-Joseph Proudhon in 1861.[25] Marx and Engels referred to the capitalistic system (kapitalistisches System)[26][27] and to the capitalist mode of production (kapitalistische Produktionsform) in Das Kapital (1867).[28] The use of the word "capitalism" in reference to an economic system appears twice in Volume I of Das Kapital, p. 124 (German edition), and in Theories of Surplus Value, tome II, p. 493 (German edition). Marx did not extensively use the form capitalism, but instead those of capitalist and capitalist mode of production, which appear more than 2600 times in the trilogy Das Kapital.

Marx's notion of the capitalist mode of production is characterised as a system of primarily private ownership of the means of production in a mainly market economy, with a legal framework on commerce and a physical infrastructure provided by the state.[29] Engels made more frequent use of the term capitalism; volumes II and III of Das Kapital, both edited by Engels after Marx's death, contain the word "capitalism" four and three times, respectively. The three combined volumes of Das Kapital (1867, 1885, 1894) contain the word capitalist more than 2,600 times.

An 1877 work entitled Better Times by Hugh Gabutt and an 1884 article in the Pall Mall Gazette also used the term capitalism.[21] A later use of the term capitalism to describe the production system was by the German economist Werner Sombart, in his 1902 book The Jews and Modern Capitalism (Die Juden und das Wirtschaftsleben). Sombart's close friend and colleague, Max Weber, also used capitalism in his 1904 book The Protestant Ethic and the Spirit of Capitalism (Die protestantische Ethik und der Geist des Kapitalismus).

Economic elements

Capitalist economics developed out of the interactions of the following elements.

A product is any good produced for exchange on a market. "Commodities" refers to standard products, especially raw materials such as grains and metals, that are not associated with particular producers or brands and trade on organized exchanges.

There are two types of products: capital goods and consumer goods. Capital goods (i.e., raw materials, tools, industrial machines, vehicles and factories) are used to produce consumer goods (e.g., televisions, cars, computers, houses) to be sold to others. The three inputs required for production are labor, land (i.e., natural resources, which exist prior to human beings) and capital goods. Capitalism entails the private ownership of the latter two—natural resources and capital goods—by a class of owners called capitalists, either individually, collectively or through a state apparatus that operates for a profit or serves the interests of capital owners.

Money was primarily a standardized medium of exchange, and final means of payment, that serves to measure the value all goods and commodities in a standard of value. It eliminates the cumbersome system of barter by separating the transactions involved in the exchange of products, thus greatly facilitating specialization and trade through encouraging the exchange of commodities. Capitalism involves the further abstraction of money into other exchangeable assets and the accumulation of money through ownership, exchange, interest and various other financial instruments. However, besides serving as a medium of exchange for labour, goods and services, money is also a store of value, similar to precious metals.

Labour includes all physical and mental human resources, including entrepreneurial capacity and management skills, which are needed to produce products and services. Production is the act of making products or services by applying labour power to the means of production.[30][31]

History

Mercantilism

The period between the sixteenth and eighteenth centuries is commonly described as mercantilism.[32] This period was associated with geographic exploration of the Age of Discovery being exploited by merchant overseas traders, especially from England and the Low Countries; the European colonization of the Americas; and the rapid growth in overseas trade. Mercantilism was a system of trade for profit, although commodities were still largely produced by non-capitalist production methods.[4]

While some scholars see mercantilism as the earliest stage of capitalism, others argue that capitalism did not emerge until later. For example, Karl Polanyi, noted that "mercantilism, with all its tendency toward commercialization, never attacked the safeguards which protected [the] two basic elements of production—labor and land—from becoming the elements of commerce"; thus mercantilist attitudes towards economic regulation were closer to feudalist attitudes, "they disagreed only on the methods of regulation."

Moreover Polanyi argued that the hallmark of capitalism is the establishment of generalized markets for what he referred to as the "fictitious commodities": land, labor, and money. Accordingly, "not until 1834 was a competitive labor market established in England, hence industrial capitalism as a social system cannot be said to have existed before that date."[33]

Evidence of long-distance merchant-driven trade motivated by profit has been found as early as the second millennium BC, with the Old Assyrian merchants.[34] The earliest forms of mercantilism date back to the Roman Empire. When the Roman Empire expanded, the mercantilist economy expanded throughout Europe. After the collapse of the Roman Empire, most of the European economy became controlled by local feudal powers, and mercantilism collapsed there. However, mercantilism persisted in Arabia. Due to its proximity to neighboring countries, the Arabs established trade routes to Egypt, Persia, and Byzantium. As Islam spread in the seventh century, mercantilism spread rapidly to Spain, Portugal, Northern Africa, and Asia. Mercantilism finally revived in Europe in the fourteenth century, as mercantilism spread from Spain and Portugal.[35]

Among the major tenets of mercantilist theory was bullionism, a doctrine stressing the importance of accumulating precious metals. Mercantilists argued that a state should export more goods than it imported so that foreigners would have to pay the difference in precious metals. Mercantilists asserted that only raw materials that could not be extracted at home should be imported; and promoted government subsidies, such as the granting of monopolies and protective tariffs, were necessary to encourage home production of manufactured goods.

European merchants, backed by state controls, subsidies, and monopolies, made most of their profits from the buying and selling of goods. In the words of Francis Bacon, the purpose of mercantilism was "the opening and well-balancing of trade; the cherishing of manufacturers; the banishing of idleness; the repressing of waste and excess by sumptuary laws; the improvement and husbanding of the soil; the regulation of prices…"[36]

Similar practices of economic regimentation had begun earlier in the medieval towns. However, under mercantilism, given the contemporaneous rise of absolutism, the state superseded the local guilds as the regulator of the economy. During that time the guilds essentially functioned like cartels that monopolized the quantity of craftsmen to earn above-market wages.[37]

At the period from the eighteenth century, the commercial stage of capitalism originated from the start of the British East India Company and the Dutch East India Company.[11][38] These companies were characterized by their colonial and expansionary powers given to them by nation-states.[11] During this era, merchants, who had traded under the previous stage of mercantilism, invested capital in the East India Companies and other colonies, seeking a return on investment. In his "History of Economic Analysis," Austrian economist Joseph Schumpeter reduced mercantilist propositions to three main concerns: exchange controls, export monopolism and balance of trade.[39]

Industrialism

A new group of economic theorists, led by David Hume[41] and Adam Smith, in the mid 18th century, challenged fundamental mercantilist doctrines as the belief that the amount of the world’s wealth remained constant and that a state could only increase its wealth at the expense of another state.

During the Industrial Revolution, the industrialist replaced the merchant as a dominant actor in the capitalist system and effected the decline of the traditional handicraft skills of artisans, guilds, and journeymen. Also during this period, the surplus generated by the rise of commercial agriculture encouraged increased mechanization of agriculture. Industrial capitalism marked the development of the factory system of manufacturing, characterized by a complex division of labor between and within work process and the routinization of work tasks; and finally established the global domination of the capitalist mode of production.[32]

Britain also abandoned its protectionist policy, as embraced by mercantilism. In the 19th century, Richard Cobden and John Bright, who based their beliefs on the Manchester School, initiated a movement to lower tariffs.[42] In the 1840s, Britain adopted a less protectionist policy, with the repeal of the Corn Laws and the Navigation Acts.[32] Britain reduced tariffs and quotas, in line with Adam Smith and David Ricardo's advocacy for free trade.

Karl Polanyi argued that capitalism did not emerge until the progressive commodification of land, money, and labor culminating in the establishment of a generalized labor market in Britain in the 1830s. For Polanyi, "the extension of the market to the elements of industry - land, labor and money - was the inevitable consequence of the introduction of the factory system in a commercial society."[43] Other sources argued that mercantilism fell after the repeal of the Navigation Acts in 1849.[42][44][45]

Keynesianism and neoliberalism

In the period following the global depression of the 1930s, the state played an increasingly prominent role in the capitalistic system throughout much of the world.

After World War I, a broad array of new analytical tools in the social sciences were developed to explain the social and economic trends of the period, including the concepts of post-industrial society and the welfare state.[32] This era was greatly influenced by Keynesian economic stabilization policies. The postwar boom ended in the late 1960s and early 1970s, and the situation was worsened by the rise of stagflation.[46]

Exceptionally high inflation combined with slow output growth, rising unemployment, and eventually recession to cause a loss of credibility in the Keynesian welfare-statist mode of regulation. Under the influence of Friedrich Hayek and Milton Friedman, Western states embraced policy prescriptions inspired by laissez-faire capitalism and classical liberalism.

In particular, monetarism, a theoretical alternative to Keynesianism that is more compatible with laissez-faire, gained increasing prominence in the capitalist world, especially under the leadership of Ronald Reagan in the US and Margaret Thatcher in the UK in the 1980s. Finally, the general public's interest was shifted from the collectivist concerns of Keynes's managed capitalism to a focus on individual freedom and choice, called "remarketized capitalism." [47] In the eyes of many economic and political commentators, the collapse of the Soviet Union brought further evidence of the superiority of market capitalism over communism.

Globalization

Although international trade has been associated with the development of capitalism for over five hundred years, some thinkers argue that a number of trends associated with globalization have acted to increase the mobility of people and capital since the last quarter of the 20th century, combining to circumscribe the room to maneuver of states in choosing non-capitalist models of development. Today, these trends have bolstered the argument that capitalism should now be viewed as a truly world system.[32] However, other thinkers argue that globalization, even in its quantitative degree, is no greater now than during earlier periods of capitalist trade.[48]

Perspectives

Classical political economy

The classical school of economic thought emerged in Britain in the late 18th century. The classical political economists Adam Smith, David Ricardo, Jean-Baptiste Say, and John Stuart Mill published analyses of the production, distribution and exchange of goods in a market that have since formed the basis of study for most contemporary economists.

In France, 'Physiocrats' like François Quesnay promoted free trade based on a conception that wealth originated from land. Quesnay's Tableau Économique (1759), described the economy analytically and laid the foundation of the Physiocrats' economic theory, followed by Anne Robert Jacques Turgot who opposed tariffs and customs duties and advocated free trade. Richard Cantillon defined long-run equilibrium as the balance of flows of income, and argued that the supply and demand mechanism around land influenced short-term prices.

Smith's attack on mercantilism and his reasoning for "the system of natural liberty" in The Wealth of Nations (1776) are usually taken as the beginning of classical political economy. Smith devised a set of concepts that remain strongly associated with capitalism today, particularly his theory of the "invisible hand" of the market, through which the pursuit of individual self-interest unintentionally produces a collective good for society. It was necessary for Smith to be so forceful in his argument in favor of free markets because he had to overcome the popular mercantilist sentiment of the time period.[49]

He criticized monopolies, tariffs, duties, and other state enforced restrictions of his time and believed that the market is the most fair and efficient arbitrator of resources. This view was shared by David Ricardo, second most important of the classical political economists and one of the most influential economists of modern times.[50]

In The Principles of Political Economy and Taxation (1817), he developed the law of comparative advantage, which explains why it is profitable for two parties to trade, even if one of the trading partners is more efficient in every type of economic production. This principle supports the economic case for free trade. Ricardo was a supporter of Say's Law and held the view that full employment is the normal equilibrium for a competitive economy.[51] He also argued that inflation is closely related to changes in quantity of money and credit and was a proponent of the law of diminishing returns, which states that each additional unit of input yields less and less additional output.[52]

The values of classical political economy are strongly associated with the classical liberal doctrine of minimal government intervention in the economy, though it does not necessarily oppose the state's provision of a few basic public goods.[53] Classical liberal thought has generally assumed a clear division between the economy and other realms of social activity, such as the state.[54]

While economic liberalism favors markets unfettered by the government, it maintains that the state has a legitimate role in providing public goods.[55] For instance, Adam Smith argued that the state has a role in providing roads, canals, schools and bridges that cannot be efficiently implemented by private entities. However, he preferred that these goods should be paid proportionally to their consumption (e.g. putting a toll). In addition, he advocated retaliatory tariffs to bring about free trade, and copyrights and patents to encourage innovation.[55]

Marxist political economy

Karl Marx considered capitalism to be a historically specific mode of production (the way in which the productive property is owned and controlled, combined with the corresponding social relations between individuals based on their connection with the process of production) in which capitalism has become the dominant mode of production.[32]

The capitalist stage of development or "bourgeois society," for Marx, represented the most advanced form of social organization to date, but he also thought that the working classes would come to power in a worldwide socialist or communist transformation of human society as the end of the series of first aristocratic, then capitalist, and finally working class rule was reached.[56][57]

Following Adam Smith, Marx distinguished the use value of commodities from their exchange value in the market. Capital, according to Marx, is created with the purchase of commodities for the purpose of creating new commodities with an exchange value higher than the sum of the original purchases. For Marx, the use of labor power had itself become a commodity under capitalism; the exchange value of labor power, as reflected in the wage, is less than the value it produces for the capitalist.

This difference in values, he argues, constitutes surplus value, which the capitalists extract and accumulate. In his book Capital, Marx argues that the capitalist mode of production is distinguished by how the owners of capital extract this surplus from workers—all prior class societies had extracted surplus labor, but capitalism was new in doing so via the sale-value of produced commodities.[58] He argues that a core requirement of a capitalist society is that a large portion of the population must not possess sources of self-sustenance that would allow them to be independent, and must instead be compelled, to survive, to sell their labor for a living wage.[59][60][61]

In conjunction with his criticism of capitalism was Marx's belief that exploited labor would be the driving force behind a revolution to a socialist-style economy.[62] For Marx, this cycle of the extraction of the surplus value by the owners of capital or the bourgeoisie becomes the basis of class struggle. This argument is intertwined with Marx's version of the labor theory of value asserting that labor is the source of all value, and thus of profit.

Vladimir Lenin, in Imperialism, the Highest Stage of Capitalism (1916), modified classic Marxist theory and argued that capitalism necessarily induced monopoly capitalism—which he also called "imperialism"—to find new markets and resources, representing the last and highest stage of capitalism.[63] Some 20th century Marxian economists consider capitalism to be a social formation where capitalist class processes dominate, but are not exclusive.[64]

Capitalist class processes, to these thinkers, are simply those in which surplus labor takes the form of surplus value, usable as capital; other tendencies for utilization of labor nonetheless exist simultaneously in existing societies where capitalist processes are predominant. However, other late Marxian thinkers argue that a social formation as a whole may be classed as capitalist if capitalism is the mode by which a surplus is extracted, even if this surplus is not produced by capitalist activity, as when an absolute majority of the population is engaged in non-capitalist economic activity.[65]

David Harvey extends Marxian thinking through which he theorizes the differential production of place, space and political activism under capitalism. He uses Marx’s theory of crisis to aid his argument that capitalism must have its “fixes” but that we cannot predetermine what fixes will be implemented, nor in what form they will be.

This idea of fix is suggestive and could mean fix as in stabilize, heal or solve, or as in a junky needing a fix – the idea of preventing feeling worse in order to feel better. In Limits to Capital (1982), Harvey outlines an overdetermined, spatially restless capitalism coupled with the spatiality of crisis formation and its resolution. Furthermore, his work has been central for understanding the contractions of capital accumulation and international movements of capitalist modes of production and money flows.[66]

In his essay, Notes towards a theory of uneven geographical development, Harvey examines the causes of the extreme volatility in contemporary political economic fortunes across and between spaces of the world economy. He bases this uneven development on four conditionalities, being: The material embedding of capital accumulation processes in the web of socio-ecological life; accumulation by dispossession; the law-like character of capital accumulation in space and time; and, political, social and “class” struggles at a variety of geographical scales.[67]

Weberian political sociology

In some social sciences, the understanding of the defining characteristics of capitalism has been strongly influenced by 19th century German social theorist Max Weber. Weber considered market exchange, rather than production, as the defining feature of capitalism; capitalist enterprises, in contrast to their counterparts in prior modes of economic activity, was their rationalization of production, directed toward maximizing efficiency and productivity; a tendency leading to a sociological process of enveloping 'rationalization'. According to Weber, workers in pre-capitalist economic institutions understood work in terms of a personal relationship between master and journeyman in a guild, or between lord and peasant in a manor.[68]

In his book The Protestant Ethic and the Spirit of Capitalism (1904–1905), Weber sought to trace how a particular form of religious spirit, infused into traditional modes of economic activity, was a condition of possibility of modern western capitalism. For Weber, the 'spirit of capitalism' was, in general, that of ascetic Protestantism; this ideology was able to motivate extreme rationalization of daily life, a propensity to accumulate capital by a religious ethic to advance economically, and thus also the propensity to reinvest capital: this was sufficient, then, to create "self-mediating capital" as conceived by Marx.

This is pictured in Proverbs 22:29, “Seest thou a man diligent in his calling? He shall stand before kings” and in Colossians 3:23, "Whatever you do, do your work heartily, as for the Lord rather than for men." In the Protestant Ethic, Weber further stated that “moneymaking – provided it is done legally – is, within the modern economic order, the result and the expression of diligence in one’s calling…”

And, "If God show you a way in which you may lawfully get more than in another way (without wrong to your soul or to any other), if you refuse this, and choose the less gainful way, you cross one of the ends of your calling, and you refuse to be God's steward, and to accept His gifts and use them for him when He requierth it: you may labour to be rich for God, though not for the flesh and sin" (p. 108).

Western Capitalism, was, most generally for Weber, the "rational organization of formally free labor." The idea of the "formally free" laborer, meant, in the double sense of Marx, that the laborer was both free to own property, and free of the ability to reproduce his labor power, i.e., was the victim of expropriation of his means of production. It is only on these conditions, still abundantly obvious in the modern world of Weber, that western capitalism is able to exist.

For Weber, modern western capitalism represented the order "now bound to the technical and economic conditions of machine production which to-day determine the lives of all the individuals who are born into this mechanism, not only those directly concerned with economic acquisition, with irresistible force. Perhaps it will so determine them until the last ton of fossilized coal is burnt" (p. 123).[69] This is further seen in his criticism of "specialists without spirit, hedonists without a heart" that were developing, in his opinion, with the fading of the original Puritan "spirit" associated with capitalism.

Institutional economics

Institutional economics, once the main school of economic thought in the United States, holds that capitalism cannot be separated from the political and social system within which it is embedded. It emphasizes the legal foundations of capitalism (see John R. Commons) and the evolutionary, habituated, and volitional processes by which institutions are erected and then changed (see John Dewey, Thorstein Veblen, and Daniel Bromley.)

One key figure in institutional economics was Thorstein Veblen who in his book The Theory of the Leisure Class (1899) analyzed the motivations of wealthy people in capitalism who conspicuously consumed their riches as a way of demonstrating success. The concept of conspicuous consumption was in direct contradiction to the neoclassical view that capitalism was efficient.

In The Theory of Business Enterprise (1904) Veblen distinguished the motivations of industrial production for people to use things from business motivations that used, or misused, industrial infrastructure for profit, arguing that the former is often hindered because businesses pursue the latter. Output and technological advance are restricted by business practices and the creation of monopolies. Businesses protect their existing capital investments and employ excessive credit, leading to depressions and increasing military expenditure and war through business control of political power.

German Historical School and Austrian School

From the perspective of the German Historical School, capitalism is primarily identified in terms of the organization of production for markets. Although this perspective shares similar theoretical roots with that of Weber, its emphasis on markets and money lends it different focus.[32] For followers of the German Historical School, the key shift from traditional modes of economic activity to capitalism involved the shift from medieval restrictions on credit and money to the modern monetary economy combined with an emphasis on the profit motive.

In the late 19th century, the German Historical School of economics diverged, with the emerging Austrian School of economics, led at the time by Carl Menger. Later generations of followers of the Austrian School continued to be influential in Western economic thought through much of the 20th century. The Austrian economist Joseph Schumpeter, a forerunner of the Austrian School of economics, emphasized the "creative destruction" of capitalism—the fact that market economies undergo constant change.

At any moment of time, posits Schumpeter, there are rising industries and declining industries. Schumpeter, and many contemporary economists influenced by his work, argue that resources should flow from the declining to the expanding industries for an economy to grow, but they recognized that sometimes resources are slow to withdraw from the declining industries because of various forms of institutional resistance to change.

The Austrian economists Ludwig von Mises and Friedrich Hayek were among the leading defenders of market economy against 20th century proponents of socialist planned economies. Mises and Hayek argued that only market capitalism could manage a complex, modern economy.

Since a modern economy produces such a large array of distinct goods and services, and consists of such a large array of consumers and enterprises, asserted Mises and Hayek, the information problems facing any other form of economic organization other than market capitalism would exceed its capacity to handle information. Thinkers within Supply-side economics built on the work of the Austrian School, and particularly emphasize Say's Law: "supply creates its own demand." Capitalism, to this school, is defined by lack of state restraint on the decisions of producers.

Austrian economists claim that Marx failed to make the distinction between capitalism and mercantilism.[70][71] They argue that Marx conflated the imperialistic, colonialistic, protectionist and interventionist doctrines of mercantilism with capitalism.

Austrian economics has been a major influence on some forms of libertarianism, in which laissez-faire capitalism is considered to be the ideal economic system.[72] It influenced economists and political philosophers and theorists including Henry Hazlitt, Hans-Hermann Hoppe, Israel Kirzner, Murray Rothbard, Walter Block and Richard M. Ebeling.[73][74]

Keynesian economics

In his 1937 The General Theory of Employment, Interest, and Money, the British economist John Maynard Keynes argued that capitalism suffered a basic problem in its ability to recover from periods of slowdowns in investment. Keynes argued that a capitalist economy could remain in an indefinite equilibrium despite high unemployment.

Essentially rejecting Say's law, he argued that some people may have a liquidity preference that would see them rather hold money than buy new goods or services, which therefore raised the prospect that the Great Depression would not end without what he termed in the General Theory "a somewhat comprehensive socialization of investment."

Keynesian economics challenged the notion that laissez-faire capitalist economics could operate well on their own, without state intervention used to promote aggregate demand, fighting high unemployment and deflation of the sort seen during the 1930s. He and his followers recommended "pump-priming" the economy to avoid recession: cutting taxes, increasing government borrowing, and spending during an economic down-turn. This was to be accompanied by trying to control wages nationally partly through the use of inflation to cut real wages and to deter people from holding money.[75]

John Maynard Keynes tried to provide solutions to many of Marx’s problems without completely abandoning the classical understanding of capitalism. His work attempted to show that regulation can be effective, and that economic stabilizers can rein in the aggressive expansions and recessions that Marx disliked. These changes sought to create more stability in the business cycle, and reduce the abuses of laborers. Keynesian economists argue that Keynesian policies were one of the primary reasons capitalism was able to recover following the Great Depression.[76] The premises of Keynes’s work have, however, since been challenged by neoclassical and supply-side economics and the Austrian School.

Another challenge to Keynesian thinking came from his colleague Piero Sraffa, and subsequently from the Neo-Ricardian school that followed Sraffa. In Sraffa's highly technical analysis, capitalism is defined by an entire system of social relations among both producers and consumers, but with a primary emphasis on the demands of production. According to Sraffa, the tendency of capital to seek its highest rate of profit causes a dynamic instability in social and economic relations.

Neoclassical economics and the Chicago School

Today, the majority academic research on capitalism in the English-speaking world draws on neoclassical economic thought. It favors extensive market coordination and relatively neutral patterns of governmental market regulation aimed at maintaining property rights; deregulated labor markets; corporate governance dominated by financial owners of firms; and financial systems depending chiefly on capital market-based financing rather than state financing.

Milton Friedman took many of the basic principles set forth by Adam Smith and the classical economists and gave them a new twist. One example of this is his article in the September 1970 issue of The New York Times Magazine, where he claims that the social responsibility of business is “to use its resources and engage in activities designed to increase its profits…(through) open and free competition without deception or fraud.” This is similar to Smith’s argument that self-interest in turn benefits the whole of society.[77] Work like this helped lay the foundations for the coming marketization (or privatization) of state enterprises and the supply-side economics of Ronald Reagan and Margaret Thatcher.

The Chicago School of economics is best known for its free market advocacy and monetarist ideas. According to Friedman and other monetarists, market economies are inherently stable if left to themselves and depressions result only from government intervention.[78]

Friedman, for example, argued that the Great Depression was result of a contraction of the money supply, controlled by the Federal Reserve, and not by the lack of investment as John Maynard Keynes had argued. Ben Bernanke, current Chairman of the Federal Reserve, is among the economists today generally accepting Friedman's analysis of the causes of the Great Depression.[79]

Neoclassical economists, today the majority of economists,[80] consider value to be subjective, varying from person to person and for the same person at different times, and thus reject the labor theory of value. Marginalism is the theory that economic value results from marginal utility and marginal cost (the marginal concepts). These economists see capitalists as earning profits by forgoing current consumption, by taking risks, and by organizing production.

Neoclassical economic theory

Neoclassical economics explain capitalism as made up of individuals, enterprises, markets and government. According to their theories, individuals engage in a capitalist economy as consumers, labourers, and investors. As labourers, individuals may decide which jobs to prepare for, and in which markets to look for work. As investors they decide how much of their income to save and how to invest their savings. These savings, which become investments, provide much of the money that businesses need to grow.

Business firms decide what to produce and where this production should occur. They also purchase inputs (materials, labour, and capital). Businesses try to influence consumer purchase decisions through marketing and advertisement, as well as the creation of new and improved products. Driving the capitalist economy is the search for profits (revenues minus expenses). This is known as the profit motive, and it helps ensure that companies produce the goods and services that consumers desire and are able to buy. To be profitable, firms must sell a quantity of their product at a certain price to yield a profit. A business may lose money if sales fall too low or if its costs become too high. The profit motive encourages firms to operate more efficiently. By using less materials, labour or capital, a firm can cut its production costs, which can lead to increased profits.

An economy grows when the total value of goods and services produced rises. This growth requires investment in infrastructure, capital and other resources necessary in production. In a capitalist system, businesses decide when and how much they want to invest.

Income in a capitalist economy depends primarily on what skills are in demand and what skills are being supplied. Skills that are in scarce supply are worth more in the market and can attract higher incomes. Competition among workers for jobs — and among employers for skilled workers — help determine wage rates. Firms need to pay high enough wages to attract the appropriate workers; when jobs are scarce, workers may accept lower wages than they would when jobs are plentiful. Trade union and governments influence wages in capitalist systems. Unions act to represent their members in negotiations with employers over such things as wage rates and acceptable working conditions.

The market

In a capitalist economy, the prices of goods and services are controlled mainly through supply and demand and competition. Supply is the amount of a good or service produced by a firm and which is available for sale. Demand is the amount that people are willing to buy at a specific price. Prices tend to rise when demand exceeds supply, and fall when supply exceeds demand. In theory, the market is able to coordinate itself when a new equilibrium price and quantity is reached.

Competition arises when more than one producer is trying to sell the same or similar products to the same buyers. In capitalist theory, competition leads to innovation and more affordable prices. Without competition, a monopoly or cartel may develop. A monopoly occurs when a firm supplies the total output in the market; the firm can therefore limit output and raise prices because it has no fear of competition. A cartel is a group of firms that act together in a monopolistic manner to control output and raise prices.

Role of government

In a capitalist system, the government does not prohibit private property or prevent individuals from working where they please. The government does not prevent firms from determining what wages they will pay and what prices they will charge for their products. Many countries, however, have minimum wage laws and minimum safety standards.

Under some versions of capitalism, the government carries out a number of economic functions, such as issuing money, supervising public utilities and enforcing private contracts. Many countries have competition laws that prohibit monopolies and cartels from forming. Despite anti-monopoly laws, large corporations can form near-monopolies in some industries. Such firms can temporarily drop prices and accept losses to prevent competition from entering the market, and then raise them again once the threat of entry is reduced. In many countries, public utilities (e.g. electricity, heating fuel, communications) are able to operate as a monopoly under government regulation, due to high economies of scale.

Government agencies regulate the standards of service in many industries, such as airlines and broadcasting, as well as financing a wide range of programs. In addition, the government regulates the flow of capital and uses financial tools such as the interest rate to control factors such as inflation and unemployment.[81]

Political advocacy

Support

Economic growth

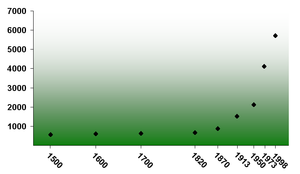

In years 1000 - 1820 world economy grew six-fold, 50 % per person. After capitalism had started to spread more widely, in years 1820 - 1998 world economy grew 50-fold, i.e., 9-fold per person.[83] In most capitalist economic regions such as Europe, the United States, Canada, Australia and New Zealand, the economy grew 19-fold per person even though these countries already had a higher starting level, and in Japan, which was poor in 1820, to 31-fold, whereas in the rest of the world the growth was only 5-fold per person.[83]

Many theorists and policymakers in predominantly capitalist nations have emphasized capitalism's ability to promote economic growth, as measured by Gross Domestic Product (GDP), capacity utilization or standard of living. This argument was central, for example, to Adam Smith's advocacy of letting a free market control production and price, and allocate resources. Many theorists have noted that this increase in global GDP over time coincides with the emergence of the modern world capitalist system.[84][85]

Proponents argue that increasing GDP (per capita) is empirically shown to bring about improved standards of living, such as better availability of food, housing, clothing, and health care.[86] The decrease in the number of hours worked per week and the decreased participation of children and the elderly in the workforce have been attributed to capitalism.[87][88][89][90]

Proponents also believe that a capitalist economy offers far more opportunities for individuals to raise their income through new professions or business ventures than do other economic forms. To their thinking, this potential is much greater than in either traditional feudal or tribal societies or in socialist societies.

Political freedom

Milton Friedman argued that the economic freedom of competitive capitalism is a requisite of political freedom. Friedman argued that centralized control of economic activity is always accompanied by political repression. In his view, transactions in a market economy are voluntary, and the wide diversity that voluntary activity permits is a fundamental threat to repressive political leaders and greatly diminish power to coerce. Friedman's view was also shared by Friedrich Hayek and John Maynard Keynes, both of whom believed that capitalism is vital for freedom to survive and thrive.[91][92]

Self-organization

Austrian School economists have argued that capitalism can organize itself into a complex system without an external guidance or planning mechanism. Friedrich Hayek coined the term "catallaxy" to describe what he considered the phenomenon of self-organization underpinning capitalism. From this perspective, in process of self-organization, the profit motive has an important role. From transactions between buyers and sellers price systems emerge, and prices serve as a signal as to the urgent and unfilled wants of people. The promise of profits gives entrepreneurs incentive to use their knowledge and resources to satisfy those wants. Thus the activities of millions of people, each seeking his own interest, are coordinated.[93]

This decentralized system of coordination is viewed by some supporters of capitalism as one of its greatest strengths. They argue that it permits many solutions to be tried, and that real-world competition generally finds a good solution to emerging challenges. In contrast, they argue, central planning often selects inappropriate solutions as a result of faulty forecasting. However, in all existing modern economies, the state conducts some degree of centralized economic planning (using such tools as allowing the country's central bank to set base interest rates), ostensibly as an attempt to improve efficiency, attenuate cyclical volatility, and further particular social goals. Proponents who follow the Austrian School argue that even this limited control creates inefficiencies because we cannot predict the long-term activity of the economy. Milton Friedman, for example, has argued that the Great Depression was caused by the erroneous policy of the Federal Reserve.[79]

Moral imperative

Ayn Rand was a notable advocate of extremist, laissez-faire capitalism, and her best-selling novel Atlas Shrugged has been an influential publication on business.[94] Rand was the first person to endow capitalism with a new code of morality--rational egoism.[95] She argued that capitalism is the only morally valid socio-political system because it allows people to be free to act in their rational self-interest.[96][97] Rand wrote: "Capitalism is a social system based on the recognition of individual rights, including property rights, in which all property is privately owned."[98]

Criticism

Notable critics of capitalism have included: socialists, anarchists, communists, technocrats, some types of conservatives, Luddites, Narodniks, Shakers and some types of nationalists. Marxists advocated a revolutionary overthrow of capitalism that would lead to socialism, before eventually transforming into communism. Marxism influenced social democratic and labour parties, as well as some moderate democratic socialists. Many aspects of capitalism have come under attack from the anti-globalization movement, which is primarily opposed to corporate capitalism.

Many religions have criticized or opposed specific elements of capitalism. Traditional Judaism, Christianity, and Islam forbid lending money at interest, although methods of banking have been developed in all three cases, and adherents to all three religions are allowed to lend to those outside of their religion. Christianity has been a source of praise for capitalism, as well as criticism of it, particularly for its materialist aspects.[99] Indian philosopher P.R. Sarkar, founder of the Ananda Marga movement, developed the Law of Social Cycle to identify the problems of capitalism.[100][101]

Critics argue that capitalism is associated with the unfair distribution of wealth and power; a tendency toward market monopoly or oligopoly (and government by oligarchy); imperialism, counter-revolutionary wars and various forms of economic and cultural exploitation; repression of workers and trade unionists, and phenomena such as social alienation, economic inequality, unemployment, and economic instability. Capitalism is regarded by many socialists to be irrational in that production and the direction of the economy are unplanned, creating many inconsistencies and internal contradictions.[102]

Environmentalists have argued that capitalism requires continual economic growth, and will inevitably deplete the finite natural resources of the earth, and other broadly utilized resources. Labor historians and scholars, such as Immanuel Wallerstein have argued that unfree labor—by slaves, indentured servants, prisoners, and other coerced persons—is compatible with capitalist relations.[103]

Democracy, the state, and legal frameworks

Private property

The relationship between the state, its formal mechanisms, and capitalist societies has been debated in many fields of social and political theory, with active discussion since the 19th century. Hernando de Soto is a contemporary economist who has argued that an important characteristic of capitalism is the functioning state protection of property rights in a formal property system where ownership and transactions are clearly recorded.[104]

According to de Soto, this is the process by which physical assets are transformed into capital, which in turn may be used in many more ways and much more efficiently in the market economy. A number of Marxian economists have argued that the Enclosure Acts in England, and similar legislation elsewhere, were an integral part of capitalist primitive accumulation and that specific legal frameworks of private land ownership have been integral to the development of capitalism.[105][106]

Institutions

New institutional economics, a field pioneered by Douglass North, stresses the need of a legal framework in order for capitalism to function optimally, and focuses on the relationship between the historical development of capitalism and the creation and maintenance of political and economic institutions.[107] In new institutional economics and other fields focusing on public policy, economists seek to judge when and whether governmental intervention (such as taxes, welfare, and government regulation) can result in potential gains in efficiency. According to Gregory Mankiw, a New Keynesian economist, governmental intervention can improve on market outcomes under conditions of "market failure", or situations in which the market on its own does not allocate resources efficiently.[108]

Market failure occurs when an externality is present and a market will either underproduce a product with a positive externality or overproduce a product that generates a negative externality. Air pollution, for instance, is a negative externality that cannot be incorporated into markets as the world’s air is not owned and then sold for use to polluters. So, too much pollution could be emitted and people not involved in the production pay the cost of the pollution instead of the firm that initially emitted the air pollution. Critics of market failure theory, like Ronald Coase, Harold Demsetz, and James M. Buchanan argue that government programs and policies also fall short of absolute perfection. Market failures are often small, and government failures are sometimes large. It is therefore the case that imperfect markets are often better than imperfect governmental alternatives. While all nations currently have some kind of market regulations, the desirable degree of regulation is disputed.

Democracy

The relationship between democracy and capitalism is a contentious area in theory and popular political movements. The extension of universal adult male suffrage in 19th century Britain occurred along with the development of industrial capitalism, and democracy became widespread at the same time as capitalism, leading many theorists to posit a causal relationship between them, or that each affects the other. However, in the 20th century, according to some authors, capitalism also accompanied a variety of political formations quite distinct from liberal democracies, including fascist regimes, monarchies, and single-party states,[32] while some democratic societies such as the Bolivarian Republic of Venezuela and Anarchist Catalonia have been expressly anti-capitalist.[109]

While some thinkers argue that capitalist development more-or-less inevitably eventually leads to the emergence of democracy, others dispute this claim. Research on the democratic peace theory indicates that capitalist democracies rarely make war with one another[110] and have little internal violence. However critics of the democratic peace theory note that democratic capitalist states may fight infrequently and or never with other democratic capitalist states because of political similarity or stability rather than because they are democratic or capitalist.

Some commentators argue that though economic growth under capitalism has led to democratization in the past, it may not do so in the future, as authoritarian regimes have been able to manage economic growth without making concessions to greater political freedom.[111][112] States that have highly capitalistic economic systems have thrived under authoritarian or oppressive political systems. Singapore, which maintains a highly open market economy and attracts lots of foreign investment, does not protect civil liberties such as freedom of speech and expression. The private (capitalist) sector in the People's Republic of China has grown exponentially and thrived since its inception, despite having an authoritarian government. Private investment in Fascist states, such as Nazi Germany, greatly increased , and Augusto Pinochet's rule in Chile led to economic growth by using authoritarian means to create a safe environment for investment and capitalism.

In response to criticism of the system, some proponents of capitalism have argued that its advantages are supported by empirical research. For example, advocates of different Indices of Economic Freedom point to a statistical correlation between nations with more economic freedom (as defined by the indices) and higher scores on variables such as income and life expectancy, including the poor, in these nations.

See also

- Capitalist mode of production

- Economic liberalism

- Objectivism (Ayn Rand)

- Positive non-interventionism

- Capitalism: The Unknown Ideal by Ayn Rand

- Das Kapital by Karl Heinrich Marx

- The Theory of Business Enterprise by Thorstein Veblen

Notes

- ↑ Bessette, Joseph M. American Justice, Volume 2. Salem Press (1996). p. 637

- ↑ The Idea of Capitalism before the Industrial Revolution. Critical Issues in History. Lanham, Md: Rowman and Littlefield, 1999, p. 1

- ↑ Tormey, Simon. Anti-Capitalism. One World Publications, 2004. p. 10

- ↑ 4.0 4.1 4.2 Scott, John (2005). Industrialism: A Dictionary of Sociology. Oxford University Press.

- ↑ Tucker, Irvin B. (1997). Macroeconomics for Today. pp. 553.

- ↑ Case, Karl E. (2004). Principles of Macroeconomics. Prentice Hall.

- ↑ 7.0 7.1 Stilwell, Frank. “Political Economy: the Contest of Economic Ideas.” First Edition. Oxford University Press. Melbourne, Australia. 2002.

- ↑ "Economic systems". Encyclopedia Britannica 2007 Ultimate Reference Suite. (Chicago: Encyclopædia Britannica, 2009)

- ↑ "Capitalism". Encyclopædia Britannica.

- ↑ 10.0 10.1 10.2 10.3 10.4 Braudel, Fernand (1982). "Production, or Capitalism away from home". The Wheels of Commerce, Vol. 2, Civilization & Capitalism 15th-18th Century. Los Angeles: University of California Press. pp. 231–373. ISBN 9780520081154. http://books.google.com/?id=WPDbSXQsvGIC&lpg=PP1&dq=capitalism%20and%20civilization%20wheels%20of%20commerce&pg=PP1#v=onepage&q=.

- ↑ 11.0 11.1 11.2 Banaji, Jairus (2007). "Islam, the Mediterranean and the rise of capitalism". Journal Historical Materialism (Brill Publishers) 15: 47–74. doi:10.1163/156920607X171591.

- ↑ 12.0 12.1 12.2 Capitalism. Encyclopedia Britannica. 2006.

- ↑ Werhane, P.H. (1994). "Adam Smith and His Legacy for Modern Capitalism". The Review of Metaphysics (Philosophy Education Society, Inc.) 47 (3).

- ↑ 14.0 14.1 14.2 "free enterprise." Roget's 21st Century Thesaurus, Third Edition. Philip Lief Group 2008.

- ↑ Mutualist.org. "...based on voluntary cooperation, free exchange, or mutual aid."

- ↑ Barrons Dictionary of Finance and Investment Terms. 1995. p. 74

- ↑ "Market economy", Merriam-Webster Unabridged Dictionary

- ↑ "About Cato". Cato.org. http://www.cato.org/about.php. Retrieved 6 November 2008.

- ↑ "The Achievements of Nineteenth-Century Classical Liberalism". http://www.cato.org/university/module10.html.

Although the term "liberalism" retains its original meaning in most of the world, it has unfortunately come to have a very different meaning in late twentieth-century America. Hence terms such as "market liberalism," "classical liberalism," or "libertarianism" are often used in its place in America.

- ↑ Etymology of "Cattle"

- ↑ 21.0 21.1 21.2 21.3 21.4 James Augustus Henry Murray. "Capital". A New English Dictionary on Historical Principles. Oxford English Press. Vol 2. page 93.

- ↑ Arthur Young. Travels in France

- ↑ Ricardo, David. Principles of Political Economy and Taxation. 1821. John Murray Publisher, 3rd edition.

- ↑ Samuel Taylor Coleridge. Tabel The Complete Works of Samuel Taylor Coleridge. page 267.

- ↑ Braudel, Fernand. The Wheels of Commerce: Civilization and Capitalism 15-18 Century, Harper and Row, 1979, p.237

- ↑ Karl Marx. Chapter 16: Absolute and Relative Surplus-Value. Das Kapital.

Die Verlängrung des Arbeitstags über den Punkt hinaus, wo der Arbeiter nur ein Äquivalent für den Wert seiner Arbeitskraft produziert hätte, und die Aneignung dieser Mehrarbeit durch das Kapital - das ist die Produktion des absoluten Mehrwerts. Sie bildet die allgemeine Grundlage des kapitalistischen Systems und den Ausgangspunkt der Produktion des relativen Mehrwerts.

The prolongation of the working-day beyond the point at which the labourer would have produced just an equivalent for the value of his labour-power, and the appropriation of that surplus-labour by capital, this is production of absolute surplus-value. It forms the general groundwork of the capitalist system, and the starting-point for the production of relative surplus-value.

- ↑ Karl Marx. Chapter Twenty-Five: The General Law of Capitalist Accumulation. Das Kapital.

- Die Erhöhung des Arbeitspreises bleibt also eingebannt in Grenzen, die die Grundlagen des kapitalistischen Systems nicht nur unangetastet lassen, sondern auch seine Reproduktion auf wachsender Stufenleiter sichern.

- Die allgemeinen Grundlagen des kapitalistischen Systems einmal gegeben, tritt im Verlauf der Akkumulation jedesmal ein Punkt ein, wo die Entwicklung der Produktivität der gesellschaftlichen Arbeit der mächtigste Hebel der Akkumulation wird.

- Wir sahen im vierten Abschnitt bei Analyse der Produktion des relativen Mehrwerts: innerhalb des kapitalistischen Systems vollziehn sich alle Methoden zur Steigerung der gesellschaftlichen Produktivkraft der Arbeit auf Kosten des individuellen Arbeiters;

- ↑ Saunders, Peter (1995). Capitalism. University of Minnesota Press. p. 1

- ↑ Karl Marx. Das Kapital.

- ↑ Ragan, Christopher T.S., and Richard G. Lipsey. Microeconomics. Twelfth Canadian Edition ed. Toronto: Pearson Education Canada, 2008. Print.

- ↑ Robbins, Richard H. Global problems and the culture of capitalism. Boston: Allyn & Bacon, 2007. Print.

- ↑ 32.0 32.1 32.2 32.3 32.4 32.5 32.6 32.7 Burnham, Peter (2003). Capitalism: The Concise Oxford Dictionary of Politics. Oxford University Press.

- ↑ Polanyi, Karl. The Great Transformation. Beacon Press, Boston.1944.p87

- ↑ Warburton, David, Macroeconomics from the beginning: The General Theory, Ancient Markets, and the Rate of Interest. Paris: Recherches et Publications, 2003.p49

- ↑ The Rise of Capitalism

- ↑ Quoted in Sir George Clark, The Seventeenth Century (New York: Oxford University Pres, 1961), p. 24.

- ↑ Mancur Olson, The rise and decline of nations: economic growth, staglaction, and social rigidities (New Haven & London 1982).

- ↑ Economic system :: Market systems. Encyclopedia Britannica. 2006. http://www.britannica.com/EBchecked/topic/178493/economic-system/61117/Market-systems#toc242146.

- ↑ Schumpeter, J.A. (1954) History of Economic Analysis

- ↑ Watt steam engine image: located in the lobby of into the Superior Technical School of Industrial Engineers of a the UPM (Madrid)

- ↑ Hume, David (1752). Political Discourses. Edinburgh: A. Kincaid & A. Donaldson.

- ↑ 42.0 42.1 "laissez-faire". http://www.bartleby.com/65/la/laissezf.html.

- ↑ Polanyi, Karl. The Great Transformation, Beacon Press. Boston. 1944. p.78

- ↑ "Navigation Acts". http://www.bartleby.com/65/na/NavigatA.html.

- ↑ LaHaye, Laura (1993). "Mercantilism". Concise Encyclepedia of Economics. Fortune Encyclopedia of Economics. http://www.econlib.org/library/Enc/Mercantilism.html.

- ↑ Barnes, Trevor J. (2004). Reading economic geography. Blackwell Publishing. pp. 127. ISBN 063123554X.

- ↑ Fulcher, James. Capitalism. 1st ed. New York: Oxford University Press, 2004.

- ↑ Henwood, Doug (1 October 2003). After the New Economy. New Press. ISBN 1-56584-770-9.

- ↑ Degen, Robert. The Triumph of Capitalism. 1st ed. New Brunswick, NJ: Transaction Publishers, 2008.

- ↑ Hunt, E.K. (2002). History of Economic Thought: A Critical Perspective. M.E. Sharpe. pp. 92.

- ↑ Blackwell Encyclopedia of Political Thought. Blackwell Publishing. 1991. pp. 91.

- ↑ Skousen, Mark (2001). The Making of Modern Economics: The Lives and Ideas of the Great Thinkers. M.E. Sharpe. pp. 98–102, 134.

- ↑ Eric Aaron, What's Right? (Dural, Australia: Rosenberg Publishing, 2003), 75.

- ↑ Calhoun, Craig (2002). Capitalism: Dictionary of the Social Sciences. Oxford University Press.

- ↑ 55.0 55.1 "Adam Smith". econlib.org. http://www.econlib.org/library/Enc/bios/Smith.html.

- ↑ The Communist Manifesto

- ↑ "To Marx, the problem of reconstituting society did not arise from some prescription, motivated by his personal predilections; it followed, as an iron-clad historical necessity – on the one hand, from the productive forces grown to powerful maturity; on the other, from the impossibility further to organize these forces according to the will of the law of value." - Leon Trotsky, "Marxism in our Time", 1939 (Inevitability of Socialism), WSWS.org

- ↑ Karl Marx. "Capital. v. 3. Chapter 47: Genesis of capitalist ground rent". Marxists. http://www.marxists.org/archive/marx/works/1894-c3/ch47.htm. Retrieved 26 February 2008.

- ↑ Karl Marx. Chapter Twenty-Five: The General Law of Capitalist Accumulation. Das Kapital.

- ↑ Dobb, Maurice 1947 Studies in the Development of Capitalism. New York: International Publishers Co., Inc.

- ↑ David Harvey 1989 The Condition of Postmodernity

- ↑ Wheen, Francis Books That Shook the World: Marx's Das Kapital1st ed. London: Atlantic Books, 2006

- ↑ "Imperialism, the Highest Stage of Capitalism". Marxists. 1916. http://www.marxists.org/archive/lenin/works/1916/imp-hsc/index.htm. Retrieved 26 February 2008.

- ↑ See, for example, the works of Stephen Resnick and Richard Wolff.

- ↑ Ste. Croix, G. E. M. de (1982). The Class Struggle in the Ancient Greek World. pp. 52–3.

- ↑ Lawson, Victoria. Making Development Geography (Human Geography in the Making). New York: A Hodder Arnold Publication, 2007. Print.

- ↑ Harvey, David. Notes towards a theory of uneven geographical development. Print.

- ↑ Kilcullen, John (1996). "Max Weber: On Capitalism". Macquarie University. http://www.humanities.mq.edu.au/Ockham/y64l10.html. Retrieved 26 February 2008.

- ↑ "Conference Agenda" (PDF). Economy and Society. http://www.economyandsociety.com/events/Ethic&SpiritCapsm_Conf_Agenda2.pdf. Retrieved 26 February 2008.

- ↑ Rothbard, Murray N. (1973). "A Future of Peace and Capitalism". Modern Political Economy (Boston: Allyn and Bacon): 419–430. http://www.mises.org/story/1559. "In fact the mercantilist system is essentially what we’ve got right now. There is very little difference between state monopoly capitalism, or corporate state capitalism, whatever you want to call it, in the United States and Western Europe today, and the mercantilist system of the pre-Industrial Revolution era. There are only two differences; one is that their major activity was commerce and ours is industry. But the essential modus operandi of the two systems is exactly the same: monopoly privilege, a complete meshing in what is now called the "partnership of government and industry," a pervasive system of militarism and war contracts, a drive toward war and imperialism; the whole shebang characterized the seventeenth and eighteenth centuries.".

- ↑ Osterfeld, David (1991). "Marxism, Capitalism and Mercantilism". The Review of Austrian Eonomics 5 (1): 107–114. ISSN 0889-304.

- ↑ What is Austrian Economics?, Ludwig Von Mises Institute.

- ↑ DiLorenzo, Thomas. "Frederic Bastiat (1801-1850): Between the French and Marginalist Revolutions." Mises.org

- ↑ Mises.org, Thornton, Mark. "Frédéric Bastiat as an Austrian Economist."

- ↑ Paul Mattick. "Marx and Keynes: the limits of the mixed economy". Marxists. http://www.marxists.org/archive/mattick-paul/1969/marx-keynes/ch01.htm. Retrieved 26 February 2008.

- ↑ Erhardt III, Erwin. "History of Economic Development." University of Cincinnati. Lindner Center Auditorium, Cincinnati. 7 Nov. 2008.

- ↑ Friedman, Milton. "The Social Responsibility of Business is to Increase its Profits." The New York Times Magazine 13 Sep. 1970.

- ↑ Felderer, Bernhard. Macroeconomics and New Macroeconomics.

- ↑ 79.0 79.1 Ben Bernanke (8 November 2002). "Remarks by Governor Ben S. Bernanke". The Federal Reserve Board. http://www.federalreserve.gov/BOARDDOCS/SPEECHES/2002/20021108/default.htm. Retrieved 26 February 2008.

- ↑ Yonary, Yuval P. (1998). The Struggle Over the Soul of Economics. Princeton University Press. pp. 29. ISBN 0691034192.

- ↑ "Capitalism." World Book Encyclopedia. 1988. 194. Print.

- ↑ Angus Maddison (2001). The World Economy: A Millennial Perspective. Paris: OECD. ISBN 92-64-18998-X.

- ↑ 83.0 83.1 Martin Wolf, Why Globalization works, s. 43-45

- ↑ Robert E. Lucas Jr.. "The Industrial Revolution: Past and Future". Federal Reserve Bank of Minneapolis 2003 Annual Report. http://www.minneapolisfed.org/pubs/region/04-05/essay.cfm. Retrieved 26 February 2008.

- ↑ J. Bradford DeLong. "Estimating World GDP, One Million B.C. – Present". http://www.j-bradford-delong.net/TCEH/1998_Draft/World_GDP/Estimating_World_GDP.html. Retrieved 26 February 2008.

- ↑ Clark Nardinelli. "Industrial Revolution and the Standard of Living". http://www.econlib.org/library/Enc/IndustrialRevolutionandtheStandardofLiving.html. Retrieved 26 February 2008.

- ↑ Barro, Robert J. (1997). Macroeconomics. MIT Press. ISBN 0262024365.

- ↑ "Labor and Minimum Wages". Capitalism.org. http://www.capitalism.org/faq/labor.htm. Retrieved 26 February 2008.

- ↑ Woods, Thomas E. (5 April 2004). "Morality and Economic Law: Toward a Reconciliation". Ludwig von Mises Institute. http://www.mises.org/article.aspx?Id=1481. Retrieved 26 February 2008.

- ↑ Norberg, Johan. "Three Cheers for Global Capitalism". The American Enterprise. http://www.taemag.com/issues/articleid.18013/article_detail.asp. Retrieved 26 February 2008.

- ↑ Friedrich Hayek (1944). The Road to Serfdom. University Of Chicago Press. ISBN 0-226-32061-8.

- ↑ Bellamy, Richard (2003). The Cambridge History of Twentieth-Century Political Thought. Cambridge University Press. pp. 60. ISBN 0-521-56354-2.

- ↑ Walberg, Herbert (2001). Education and Capitalism. Hoover Institution Press. pp. 87–89. ISBN 0-8179-3972-5.

- ↑ Ayn Rand's Literature of Capitalism, The New York Times

- ↑ Rand, Ayn, The Virtue of Selfishness: A New Concept of Egoism (1964)

- ↑ Capitalism: The Unknown Ideal

- ↑ Capitalism - Theory The Ayn Rand Lexicon.

- ↑ Capitalism - The Unknown Ideal The Ayn Rand Lexicon.

- ↑ "III. The Social Doctrine of the Church". The Vatican. http://www.vatican.va/archive/ENG0015/__P8C.HTM#-2FX. Retrieved 26 February 2008.

- ↑ Dada Maheshvarananda. "After Capitalism". http://www.prout.org/aftercapitalism/. Retrieved 26 February 2008.

- ↑ "proutworld". ProutWorld. http://www.proutworld.org/. Retrieved 26 February 2008.

- ↑ Brander, James A. Government policy toward business. 4th ed. Mississauga, Ontario: John Wiley & Sons Canada, Ltd., 2006. Print.

- ↑ That unfree labor is acceptable to capital was argued during the 1980s by Tom Brass. See Towards a Comparative Political Economy of Unfree Labor (Cass, 1999). Marcel van der Linden. ""Labour History as the History of Multitudes", Labour/Le Travail, 52, Fall 2003, p. 235-244". http://www.historycooperative.org/journals/llt/52/linden.html. Retrieved 26 February 2008.

- ↑ Hernando de Soto. "The mystery of capital". http://www.imf.org/external/pubs/ft/fandd/2001/03/desoto.htm. Retrieved 26 February 2008.

- ↑ Karl Marx. "Capital, v. 1. Part VIII: primitive accumulation". http://www.marxists.org/archive/marx/works/1867-c1/ch27.htm. Retrieved 26 February 2008.

- ↑ N. F. R. Crafts (April 1978). "Enclosure and labor supply revisited". Explorations in economic history 15 (15): 172–183. doi:10.1016/0014-4983(78)90019-0..we the say yes

- ↑ North, Douglass C. (1990). Institutions, Institutional Change and Economic Performance. Cambridge University Press.

- ↑ Principles of Economics. Harvard University. 1997. pp. 10.

- ↑ On the democratic nature of the Venezuelan state, see Gobiernoenlinea.ve. On the current government's rejection of capitalism in favor of socialism, see Gobiernoenlinea.ve and Minci.gob.ve

- ↑ For the influence of capitalism on peace, see Mousseau, M. (2009) "The Social Market Roots of Democratic Peace", International Security 33 (4)

- ↑ Mesquita, Bruce Bueno de (2005-09). "Development and Democracy". Foreign Affairs. http://www.foreignaffairs.org/20050901faessay84507/bruce-bueno-de-mesquita-george-w-downs/development-and-democracy.html. Retrieved 26 February 2008.

- ↑ Single, Joseph T. (2004-09). "Why Democracies Excel". New York Times. http://www10.nytimes.com/cfr/international/20040901facomment_v83n4_siegle-weinstein-halperin.html?_r=5&oref=slogin&oref=slogin&oref=slogin&oref=slogin. Retrieved 26 February 2008.

References

- Bacher, Christian (2007) Capitalism, Ethics and the Paradoxon of Self-exploitation Grin Verlag. p. 2

- De George, Richard T. (1986) Business ethics p. 104

- Lash, Scott and Urry, John (2000). Capitalism. In Nicholas Abercrombie, S. Hill & BS Turner (Eds.), The Penguin dictionary of sociology (4th ed.) (pp. 36–40).

- Obrinsky, Mark (1983). Profit Theory and Capitalism. University of Pennsylvania Press. pp. 1. http://www.questia.com/PM.qst?a=o&d=4995059.

- Wolf, Eric (1982) Europe and the People Without History

- Wood, Ellen Meiksins (2002) The Origins of Capitalism: A Longer View London: Verso

Further reading

- Abu-Lughod, Janet L. Before European Hegemony The World System A.D. 1250-1350. New York: Oxford UP, USA, 1991.

- Ackerman, Frank; Lisa Heinzerling (24 August 2005). Priceless: On Knowing the Price of Everything and the Value of Nothing. New Press. pp. 277. ISBN 1565849817.

- Buchanan, James M.. Politics Without Romance.

- Braudel, Fernand. Civilization and Capitalism: 15th - 18 Century.

- Bottomore, Tom (1985). Theories of Modern Capitalism.

- H. Doucouliagos and M. Ulubasoglu (2006). "Democracy and Economic Growth: A meta-analysis". School of Accounting, Economics and Finance Deakin University Australia.

- Coase, Ronald (1974). The Lighthouse in Economics.

- Demsetz, Harold (1969). Information and Efficiency.

- Fulcher, James (2004). Capitalism.

- Friedman, Milton (1952). Capitalism and Freedom.

- Galbraith, J.K. (1952). American Capitalism.

- Böhm-Bawerk, Eugen von (1890). Capital and Interest: A Critical History of Economical Theory. London: Macmillan and Co..

- Harvey, David (1990). The Political-Economic Transformation of Late Twentieth Century Capitalism.. Cambridge, MA: Blackwell Publishers. ISBN 0-631-16294-1.

- Hayek, Friedrich A. (1975). The Pure Theory of Capital. Chicago: University of Chicago Press. ISBN 0-226-32081-2.

- Hayek, Friedrich A. (1963). Capitalism and the Historians. Chicago: University of Chicago Press.

- Heilbroner, Robert L. (1966). The Limits of American Capitalism.

- Heilbroner, Robert L. (1985). The Nature and Logic of Capitalism.

- Heilbroner, Robert L. (1987). Economics Explained.

- Cryan, Dan (2009). Capitalism: A Graphic Guide.

- Josephson, Matthew, The Money Lords; the great finance capitalists, 1925-1950, New York, Weybright and Talley, 1972.

- Luxemburg, Rosa (1913). The Accumulation of Capital.

- Marx, Karl (1886). Capital: A Critical Analysis of Capitalist Production.

- Mises, Ludwig von (1998). Human Action: A Treatise on Economics. Scholars Edition.

- Rand, Ayn (1986). Capitalism: The Unknown Ideal. Signet.

- Reisman, George (1996). Capitalism: A Treatise on Economics. Ottawa, Illinois: Jameson Books. ISBN 0-915463-73-3.

- Resnick, Stephen (1987). Knowledge & Class: a Marxian critique of political economy. Chicago: University of Chicago Press.

- Rostow, W. W. (1960). The Stages of Economic Growth: A Non-Communist Manifesto. Cambridge: Cambridge University Press.

- Schumpeter, J. A. (1983). Capitalism, Socialism, and Democracy.

- Scott, Bruce (2009). The Concept of Capitalism. Springer. pp. 76. ISBN 3642031099.

- Scott, John (1997). Corporate Business and Capitalist Classes.

- Seldon, Arthur (2007). Capitalism: A Condensed Version. London: Institute of Economic Affairs.

- Sennett, Richard (2006). The Culture of the New Capitalism.

- Smith, Adam (1776). An Inquiry into the Nature and Causes of the Wealth of Nations.

- De Soto, Hernando (2000). The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else. New York: Basic Books. ISBN 0-465-01614-6.

- Strange, Susan (1986). Casino Capitalism.

- Wallerstein, Immanuel. The Modern World System.

- Weber, Max (1926). The Protestant Ethic and the Spirit of Capitalism.

External links

- Center on Capitalism and Society directed by Edmund Phelps

|

|||||||||||